Robert McEwen, chairman and CEO of U.S. Gold (UGX-T, UXG-X), looks to the recent discovery of the 8-million-oz. Cortez Hills deposit by Placer Dome (now Barrick Gold [ABX-T, ABX-N]) as the motivation for heading a new exploration vehicle positioned on Nevada’s prolific Battle Mountain-Cortez trend — coupled with his conviction that the gold price is going higher.

When McEwen stepped down as Goldcorp’s (G-T, GG-N) CEO in February 2005, he looked for a new place to hang his hat and felt the juniors offered the best potential for real price movements. McEwen initially acquired a 33% stake in U.S. Gold in July 2005 by purchasing 11.1 million shares priced at US36 apiece in the then over-the-counter trader. With his US$4-million investment, McEwen assumed the role of chairman and CEO.

“From a geopolitical standpoint and from a currency standpoint, I thought North America is a pretty good place (to be), particularly the United States — and that is a change in thinking because in the early ’90s, everybody was leaving the United States because of regulatory problems and greener fields in the developing world,” McEwen told delegates at last year’s Denver Gold Forum. “This is the part of the world where, if the dollar continues to fall against gold, you want to have your production.”

The state of Nevada is the third-largest gold producer in the world, behind South Africa and Australia. The linear array of deposits in Nevada has led to a naming convention that incorporates a geographic reference point, giving rise to the Carlin trend, which has produced about 60 million oz. so far, and the Battle Mountain-Cortez trend. These trends are generally interpreted to reflect deep-seated crustal structural control on fluid flow and deposition of metals. The intersection of these projections with crosscutting structures and the presence of favourable host rocks are the key to guiding exploration efforts.

It is the Carlin-type, sediment-hosted gold mineralization, found predominantly at the transition between the base of the Devonian Wenban limestone and the top of the Silurian Roberts Mountain Formation, that can deliver big, bulk-minable deposits at fairly high grades.

“Our goal is to create the premier exploration company in Nevada that has a large land position and an exploration budget comparable to that of a major; that has the balance sheet and liquidity of a mid-tier, but retains the upside of a junior,” McEwen said.

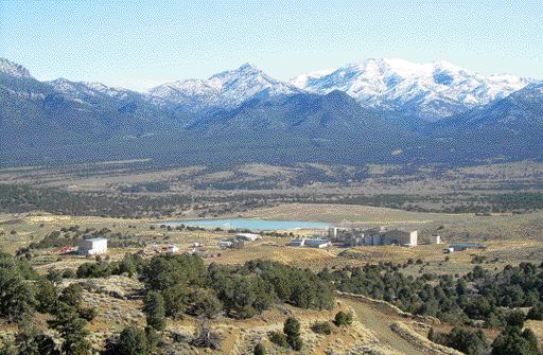

U.S. Gold’s core asset is the Tonkin Springs gold property, a former producer with a problem-plagued operating history because of its complex, refractory mineralization. BacTech Mining (bm-v, bmcff-o) had tried to revive the Tonkin Springs mine under a partnership arrangement with U.S. Gold but couldn’t raise the cash to pay a US$1.1-million reclamation bond. BacTech was forced to relinquish its 55% interest in the project in May 2005.

The big attraction now, however, is the property’s highly coveted position covering 93 sq. km along the Battle Mountain-Cortez trend, whose profile has been re-energized by the Cortez Hills discovery.

Cortez Hills

The Cortez mine lies on the Battle Mountain trend of north-central Nevada, 130 km southwest of Elko. Following its takeover of Placer Dome in early 2006, Barrick is now the operator and owns 60% of the Cortez mine. London-based Rio Tinto (RTP-N, RIO-L) owns the remaining 40%.

Since the inception of the original joint venture more than 40 years ago, the Cortez geology team has found close to 37 million contained ounces on the mine property in the measured and indicated category, including 28 million oz. on a proven and probable basis. About 89% of the mineral reserve was identified in the last 15 years, including the Pipeline deposits and the more recent Cortez Hills.

The Cortez joint venture comprises a 2,587-sq.-km area of interest, of which 1,008 sq. km are directly controlled.

Cortez Hills was discovered near the end of 2002 during an initial reverse-circulation (RC) drill program north of the 1.2-million-oz. Pediment deposit, 4 km southeast of the original Cortez mine, and 15 km southeast of the current Pipeline mining operation. The discovery came in the sixth hole of a 7-hole program that intersected 36.6 metres of 9.5 grams gold per tonne, starting 150 metres below surface. Follow-up drilling in late 2002 confirmed continuity. By April 2003, Placer had announced the initial discovery of a 3-million-oz. resource grading 2.98 grams, based on the first 40 holes.

Cortez Hills continued to grow and in a June 2004 update, Placer had outlined 7.5 million oz. in proven and probable open-pit reserves at an average grade of 5.4 grams, some 18 months after making the initial discovery. Another 615,000 oz. were classified as measured, indicated and inferred resources.

In September 2005, the Cortez joint venture approved the US$504-million development of Cortez Hills and the lower-grade Pediment deposit, based on a revised open-pit plan that is shallower than originally envisioned and contains 5.5 million oz. at a projected recovery rate of 82.5%. The pit model takes in 4.4 million oz. in 30.4 million tonnes of ore grading 4.42 grams for Cortez Hills, plus 1.2 million oz. in 34.4 million tonnes of lower-grade Pediment ore averaging 1.13 grams.

Ore from the deposits will be processed at the existing Pipeline mill or leached at a new facility to be constructed near the deposits.

A high-grade mineral resource of close to 4 million additional oz. that now sits below the bottom of the Cortez Hills pit model will be investigated as part of an underground mine development project that is already under way.

“The world has been waking up to the potential that the Battle Mountain-Cortez trend could host possibly as much gold as Carlin,” McEwen explained. “Big deposits, well-serviced in a friendly jurisdiction with the right currency, surrounded by the world’s two largest gold producers: Barrick and Newmont; that’s why I wanted to be there.”

In a 2005 letter to shareholders, McEwen wrote: “When I looked at U.S. Gold I saw a very unique and interesting opportunity. A small company with one of the largest land packages in the Cortez trend.”

With McEwen at the helm, U.S. Gold raised US$75 million in early 2006 through a private-placement financing of 16.7 million units priced at US$4.50 apiece. Each unit was comprised of one share and half a warrant. A full warrant entitles the purchase of an additional share at US$10 for a period of five years.

The company has earmarked US$30 million for exploration, including about 120,000 metres of drilling, at Tonkin Springs over the next two years.

Almost a year ago, U.S. Gold sought to consolidate a larger land package along the Cortez trend by announcing its intention to acquire White Knight Resources (WKR-V, WITNF-O), Nevada Pacific Gold (NPG-V, NVPGF-O), Tone Resources (tns-v, tonrf-o) and Coral Gold Resources (CGR-V, CGREF-O). The companies all have mineral properties along the Cortez trend that are adjacent to or near U.S. Gold’s Tonkin Springs property. McEwen also happens to be a major shareholder in each company.

U.S. Gold has yet to make a formal offer for any of the companies and recently abandoned its proposed takeover of Coral Gold in light of regulatory concerns that could further delay and possibly jeopardize the proposed offers for the other three companies.

“Our lawyers assured me this was going to be complicated but straightforward,” McEwen said. “Complicated it was; straightforward it wasn’t. Trying to take an American company and buy four Canadian companies where I was the largest shareholder in all the companies, it’s proving to be a little frustrating but nevertheless on track.”

U.S. Gold anticipates being able to begin the formal tender offers for Nevada Pacific, White Knight and Tone Resources by mid-February.

Tonkin Springs

The northern boundary of the Tonkin Springs property is 16 km south of the Cortez Hills discovery. Tonkin Springs has been heavily explored over

the last 40 years by many different operators, including Homestake Mining, Placer Amax, Precambrian Exploration, Gold Capital and Sudbury Contact Mines, a subsidiary of Agnico-Eagle Mines (AEM-T, AEM-N). A total of 2,797 holes have been drilled on the property between 1966 and 2004.

“Most of the drilling centered on few select areas, leaving the large majority of the property untested,” McEwen said in a letter to shareholders, adding the drilling was also close to surface.

Tonkin Springs features several small open-pit cuts and established mine infrastructure. Between 1985 and 1988, the mine operated as an oxide heap-leach. In late 1989, U.S. Gold completed construction of a 1,500-ton-per-day, bio-leach oxidation milling and tailings facility to treat refractory sulphide mineralization at a capital cost of US$31 million. The mine was a bust and closed after just a few months of operation in June 1990. Production during these two periods amounted to 31,000 oz.

In July 2003, BacTech Mining purchased a 55% majority stake in Tonkin Springs for US$1.7 million and a commitment to fund up to US$12 million in project development. BacTech assumed operatorship and retained Micon International to determine the economics of developing a 1.8-million-tonne-per-year open-pit mine, based on measured and indicated sulphide and oxide resources containing almost 1.3 million oz. in 26.9 million tonnes averaging 1.47 grams (the oxide component accounted for 186,000 oz.). An additional 152,000 sulphide oz. in 3.2 million tonnes grading 1.51 grams was inferred.

Conventional heap leaching was planned for the treatment of oxide ore, and bio-oxidation was proposed for the processing of sulphide material. Preliminary metallurgical testing showed that 80% of the gold could be extracted from both the oxide and sulphide component.

Minable reserves, incorporating five open pits (Rooster, F-Grid, O-15, TSP-1 and TSP-6), were estimated at 9.7 million tonnes grading 2.09 grams, equivalent to 646,000 oz. at a stripping ratio of 2.91:1. The study assumed 523,000 oz. would be recovered over a mine life of at least six years at a cash operating cost of US$238 per oz. Capital costs were projected at US$31.4 million, giving a likely rate of return of 19% assuming a gold price of US$400 per oz.

The feasibility study concluded that Tonkin Springs was both “technically feasible and economically viable,” and recommended commercial development. Micon also noted that that “the property has good potential with regards to expanding existing resources and the discovery of new gold zones.”

However, further metallurgical tests on fresh sulphide samples from deeper portions of the deposit indicated a finer crush and increased reagent consumption may be required to achieve stated recoveries.

“These early results suggest that the production plan outlined in the feasibility study may not be achievable at the projected cost reported by Micon,” stated BacTech in an August 2004 release.

Strapped for cash, BacTech was forced to relinquish its 55% interest in Tonkin Springs in April 2005, after the Nevada Bureau of Land Management came calling for US$1.1 million in new reclamation bonds covering the mine property.

Exploration

Since joining U.S. Gold, McEwen has shifted the emphasis away from short-term production and on to exploration, towards assessing the property-wide potential for deeper mineralized zones. One of the objectives is to identify new mineralization in untested areas, specifically targeting Carlin-style mineralization in the search for the next Cortez Hills.

The 1.4-million-oz. defined resource at Tonkin Springs occurs in the upper plate rocks of the Vinini Formation. Most of the large orebodies on the Battle Mountain-Cortez trend occur in the more lime-rich rocks of the lower plate Roberts Mountain Formation.

“Evidence exists that these rocks occur at some unknown depth on the property,” states Micon’s 2004 technical report.

“This lower plate has never been hit on our property,” McEwen informed shareholders. “Nevada Pacific Gold, which holds small blocks of land within Tonkin Springs, announced the discovery of lower-plate rock on its property. This is a very intriguing development in our quest for the next Cortez Hills.”

Last year, McEwen said that new interpretations, supported by age-dating, mapping, drilling and fossil identification, suggest that Tonkin hosts a larger package of lower-plate rock than previously believed.

The first phase of exploration at Tonkin Springs is designed to test for lateral and depth extensions of previously identified mineralized zones. Drilling to date has been confined to the designated mine corridor region, which is comprised of the Southern, Middle and Rooster target areas. So far, more than 16,780 metres of drilling has been completed, with assays reported for the first 26 holes totalling 10,220 metres.

The first batch of results from six holes is “nothing that is going to cause the world to jump up and down,” McEwen said. “They confirm the mineralization extends deeper and laterally. We’re looking for feeder systems.”

The mineralized rock units are described by Ann Carpenter, president of U.S. Gold, as Devonian rocks, with similarities to the rocks found north of Cortez and those that you would find south at the Ruby Hill mine. There’s a dominance of Devonian rocks in the Rooster area, where the defined ounces are. In the Middle and Southern corridor areas, there is a mix of Devonian and Ordovician rocks that are similar in appearance to what is found at Ruby Hill.

“We’re going to be drilling in excess of 400,000 feet over the next two years and I didn’t go into this thinking that my first drill hole was going to be my discovery hole,” McEwen said. “We have multiple targets to explore.”

Be the first to comment on "U.S. Gold in search of the Holy Grail"