The Alaska State Legislature has unanimously passed a bill that authorizes the Alaska Industrial Development and Export Authority (AIDEA) to issue bonds of up to US$145 million to finance some of the infrastructure costs of Ucore Rare Metals’ (TSXV: UCU; US-OTC: UURAF) wholly owned Bokan–Dotson Ridge rare earth element (REE) project.

AIDEA is a public corporation of the State of Alaska and has financed capital project initiatives in the Alaskan mining sector since 1985, including the DeLong Mountain Transportation System, which serves Teck Resources’ (TSX: TCK.B; NYSE: TCK) Red Dog zinc mine. (In that case, AIDEA built infrastructure — essentially roads — and Teck was charged a toll on the roads as a way of generating a return for the fund.)

Other AIDEA-financed projects include the Skagway Ore Terminal, the Seward Coal Terminal and mine facilities at Fort Knox. Outside of the mining sector, AIDEA was involved with the Federal Express maintenance facility in Anchorage, the Snettisham hydroelectric project in Juneau, and the Ketchikan shipyard.

Ucore’s vice-president of business development Mark MacDonald says that the proceeds of the bonds will be used to build the surface infrastructure at the Bokan project, including the processing and above-ground facilities, which then will be owned by AIDEA and leased back to the company. “It takes the expense out of our initial two-year budget and spreads it out over 11 years, so it really improves the feasibility of the project,” he explains.

“It is already a robust project, but what this does in fact is increase the IRR fairly significantly, meaning the payback will be shortened to less than a year.”

The bond financing will be subject to AIDEA’s own due diligence and board approval once Ucore completes a feasibility study on the project. MacDonald estimates the feasibility could take one year and says the company is looking for an engineering firm to do it.

“If the evolution of events in the legislature is anything to go by, Ucore may have bypassed the crocodile pit of the capital markets and gone straight to the most cashed-up source,” Christopher Ecclestone of Hallgarten & Co. commented in a research note. Ecclestone calculates the effect will be to “shift nearly two-thirds of the cost of the project off the books,” with a “dramatic impact” on the project’s net present value (NPV).

“Now the company is cashed up — more so than virtually any other REE junior — and the Alaskan legislators have done their duty and unanimously got behind the funding guarantee,” Ecclestone adds. “It is hard to see what more investors want.”

The analyst also points out that Alaska “is one of those lesser populated states where personality politics are key, and where there is much more proximity between state politicians and the Federal representatives than would be the case in a state such as New York or California . . . getting both levels of government on-board is not as complex as in bigger population states, but one level cannot be ignored or left uncultivated while pursuing the other. Ucore has diligently cultivated all levels over the years.”

The Bokan–Dotson ridge REE project is on Prince of Wales Island — 60 km southwest of Ketchikan and 140 km northwest of Prince Rupert, B.C. — and has direct ocean access to the western seaboard and the Pacific Rim, which bring some of the lowest shipping rates in the industry.

Bokan contains heavy REEs, including dysprosium, terbium and yttrium. About 40% by weight of the REEs contained on the Dotson Ridge property are heavy REEs, including dysprosium, terbium and yttrium.

MacDonald notes that Alaska is developing the mining industry in the state to help create jobs and replace declining revenues from its oil and forestry industries, and recognizes the strategic value of rare-earth minerals and related industries to the U.S.

“Alaska sees that it has a resource that has been declared critical by the Department of Energy in the U.S., and they want to play a role in making sure the U.S. has a secure domestic supply of these materials,” MacDonald says. “Rare earth elements and in particular heavy rare earth elements are a key component in a lot of high-tech and green energy products like wind and solar, as well as in defence.”

MacDonald adds that Alaskan legislators are well aware of how the rare earth industry moved to China in the 1980s to take advantage of inexpensive labour, and that they now see an opportunity to “repatriate” not only the mining and refining of rare earth minerals, but also a whole industry that has grown up around REEs, such as alloy and magnet manufacturers.

The project contains indicated resources of 2.9 million tonnes grading 0.61% total rare earth oxides (TREO) and inferred resources of 2 million tonnes grading 0.61% TREO.

A preliminary economic assessment outlined an 11-year mine life, based on an earlier inferred resource completed in 2011 of 5.3 million tonnes averaging 0.65% TREO. The study (which has yet to be updated) concluded that the project would produce an average 2,250 tonnes per year during its first five years of operation, including 95 tonnes of dysprosium oxide, 14 tonnes of terbium oxide and 515 tonnes of yttrium oxide.

The study pegged capex at US$221 million, including a complete on-site rare earth oxide separation plant and a US$25-million contingency provision. At a mining rate of 1,500 tonnes per day and average total rare earth recoveries of 81.6%, payback was estimated in 2.3 years.

The PEA estimated that Bokan–Dotson Ridge would have a pre-tax NPV of US$577 million at a 10% discount rate and a 43% internal rate of return. (The PEA, completed by Tetratech, did not include post-tax NPV and IRR numbers.)

Shares of Ucore have traded in a range of 17.5¢ to 50¢ per share over the last year, and at press time were 36¢ apiece.

UCore Mines Investors Not Land

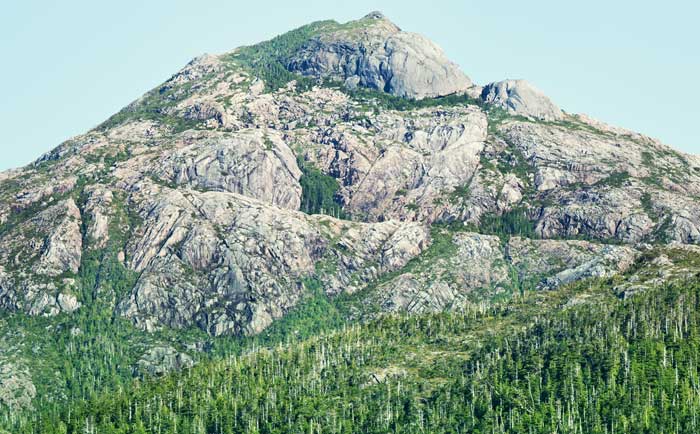

Bokan-Dotson Mountain, Alaska—Ucore Rare Earth Metals (TSXVENTURE:UCU)(UURAF)

FOR IMMEDIATE RELEASE

PRLog (Press Release) – Jun. 26, 2014 – KETCHIKAN, Alaska — UCore failed on its last two mining claims, Lost Pond in Newfoundland and Canada, leaving the sole asset Bokan-Dotson Mountain. UCore defaulted on paying annual installments of $60,000 on some of these mining claims and tried to bully other miners off their claims. Now the State of Alaska Legislature passes SB99 by willing to jeopardize its credit rating in lending $154 million Alaskan dollars to a nearly bankrupt insolvent Canadian company, UCore, who has yet to book any income within the last four years on its KPMG audited financial statements. UCore doesn’t seem to have any supplier contracts from buyer companies which any bank would require as part of the loan application if ever these mines produced anything. UCore’s current patterns of behavior suggest that UCore is only interested in speculative commodity trading contracts for its executives to fish its own penny-stocks for a profit. Historically, the people of Alaska didn’t get the high-paid jobs they were promised and were left holding unpaid bills by these companies, some to a tune of $1 million dollars nearly creating ghost-towns. UCore was given a draft two years ago for the local people to start an educational program for a specific career path for these mining jobs at UCore. UCore refused to read it much less help Alaskans into a professional high-paid career. The only thing UCore has become good at is taking your money.