Uranium Energy (NYSE-AM: UEC) has agreed to buy Rio Tinto’s (NYSE: RIO; LSE: RIO; ASX: RIO) uranium assets in Wyoming, which include the fully-licensed Sweetwater plant and a portfolio of uranium mining projects.

The uranium producer and explorer said the US$175-million cash deal would give it key assets that will allow it to boost production, providing opportunities for synergy with its other projects in Wyoming’s Great Divide Basin.

Uranium Energy estimates the transaction, to be closed in the fourth-quarter of 2024 calendar year, would add about 175 million lb. of historic resources.

“These assets will unlock tremendous value by establishing our third hub-and-spoke production platform and cement [Uranium Energy] as the leading uranium developer in Wyoming and the U.S.,” chief executive Amir Adnani said in the statement.

The Sweetwater plant is a 3,000-tonne-per-day conventional processing mill with a licensed capacity of 4.1 million lb. of triuranium octoxide (U3O8), a compound of uranium.

Uranium Energy will also add Red Desert, a development-stage uranium project, encompassing approximately 81 sq. km of exploration and mining rights, and the Green Mountain project, located 35 km north of the Sweetwater plant.

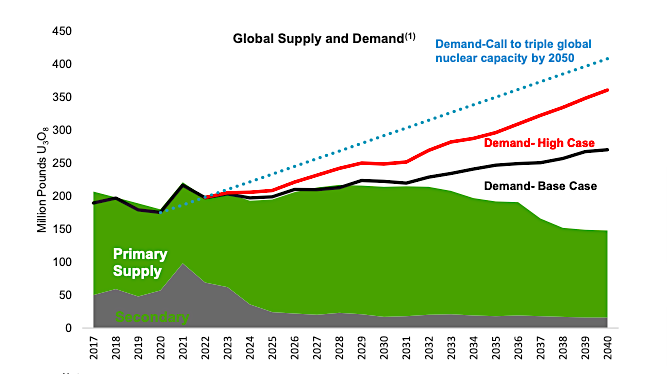

The Texas-based company said the move was a response to “unprecedented” demand for uranium and nuclear energy. This spike, it said, is being fuelled by ongoing geopolitical events, the escalating need for reliable clean energy, and the rapid adoption of AI technologies.

Uranium energy already holds the Irigaray and Christensen Ranch in situ recovery (ISR) plants in Wyoming along with a portfolio of ISR projects, plus the Hobson uranium recovery plant and ISR projects in Texas. It’s also exploring at its Roughrider deposit in Saskatchewan — bought from Rio Tinto in 2022.

Shares in Uranium Energy jumped on the news, up 6.3% to US$5.89 this morning. This leaves the company’s market capitalization at US$2.4 billion.

Be the first to comment on "Uranium Energy to buy Rio Tinto’s Wyoming assets for US$175M "