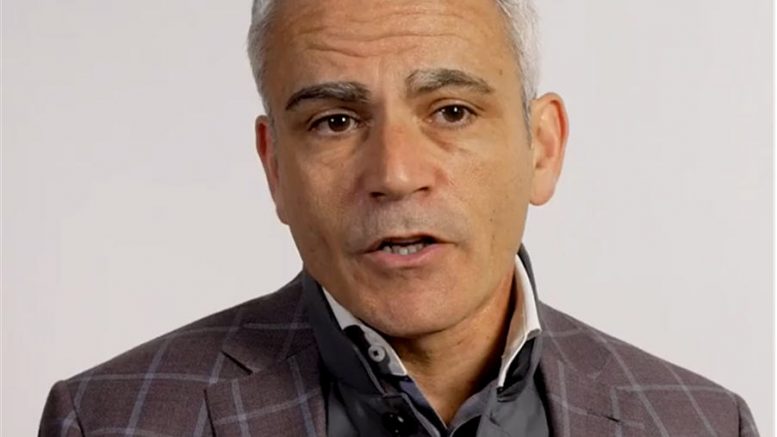

Gold-mining executive David Garofalo says the copper and gold deal-making environment has never been better. He looks to kick Gold Royalty Corp (NYSE American: GROY) growth into high gear in 2022.

The former Goldcorp boss, now in charge of Gold Royalty Corp, plans to stay its acquisition momentum.

Since its initial public offering in March last year, as an independent public company, it has already acquired three publicly traded royalty companies, massively expanding its portfolio to over 191 royalties.

In a video interview, Garofalo tells The Northern Miner he is prepared to put his global Rolodex to work to continue to aggressively acquire additional assets and increase its exposure to operating mines.

Gold Royalty has consolidated Abitibi Royalties and Golden Valley Mines & Royalties and is now pursuing a deal with Elemental Royalties Corp. (TSXV: ELE). However, the Elemental board has recommended shareholders reject the all-share hostile bid.

Garofalo said the offer already gave full value and a path to liquidity for Elemental shares.

Two equity research groups are also bullish on the issuer. Haywood Capital Markets flagged the company as positioned for a re-rating of its equity as it started to mature.

“We expect the maturing cash-generating profile to translate into market valuations consistent with more mature peers which garner premium valuation multiples relative to miners as royalty companies provide a different risk profile to investors,” said Haywood analyst Collin Healy in a recent research note.

“This potential re-rating in the market of Gold Royalty Corp shares offers a great opportunity for investors to participate in exponential growth, with the comfort of a world-class management team and board at the helm.”

Meanwhile, New York-based HC Wainwright & Co. also picked the equity as a top performer for 2022. “Key acquisitions in FY21 amid disciplined expansion strategy positions Gold Royalty Corp. as preeminent intermediate precious metals royalties company. Over the past year, GRC’s management team has successfully grown its asset-base by purchasing various royalty-based companies. In our view, this is setting up GRC for future organic growth and cash flow generation,” said analyst Heiko Ihle in a research note on February 2.

Garofalo said the mergers and acquisitions cycle that started with the 2018 takeover by Barrick Gold’s (TSX: ABX; NYSE: GOLD) merger with Randgold Resources was only gathering momentum. He also sees further consolidation in the streaming and royalty business, which offers upfront payments in exchange for the right to a percentage of production or revenue.

Garofalo said Gold Royalty would keep looking at growth opportunities as it aspires to achieve the mid-tier status that institutional investors want.

Watch the video here.

Be the first to comment on "Video: Gold Royalty Corp poised to accelerate growth in 2022, says CEO"