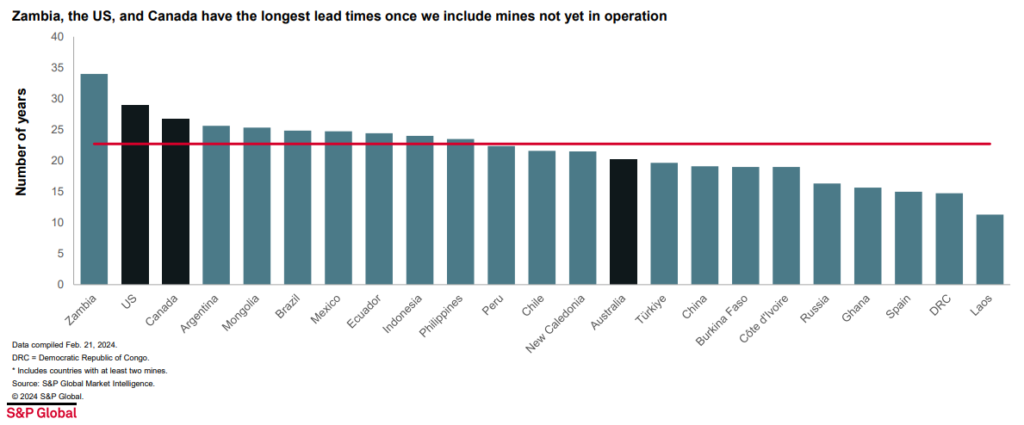

According to a new report by S&P Global, the United States has the second-longest lead times in the world for developing a new mine.

Mines in the U.S. go from discovery to production in an average of 29 years, longer than in any other country except Zambia at 34 years. Canada is not much better at around 27 years.

“The long U.S. lead times stand in contrast to the country’s sizeable resource base,” the report reads. “The U.S. copper endowment (more than 275 million metric tons in reserves and resources) is comparable to those of Canada and Australia combined and sufficient to satisfy domestic demand for the foreseeable future.”

The United States’ endowment of lithium (more than 43 million tons in reserves and resources) is more than twice that of Australia, which currently accounts for half of the world’s lithium production, S&P says.

The report also shows that the United States receives less mining exploration budgets than its advanced economy peers. Investment has been 57% higher in Australia and 81% higher in Canada over the past 15 years. There’s greater certainty that mines can be developed in both countries, S&P said.

The report examines 268 mines worldwide to determine average development times from discovery to production. Most of the mines are operating.

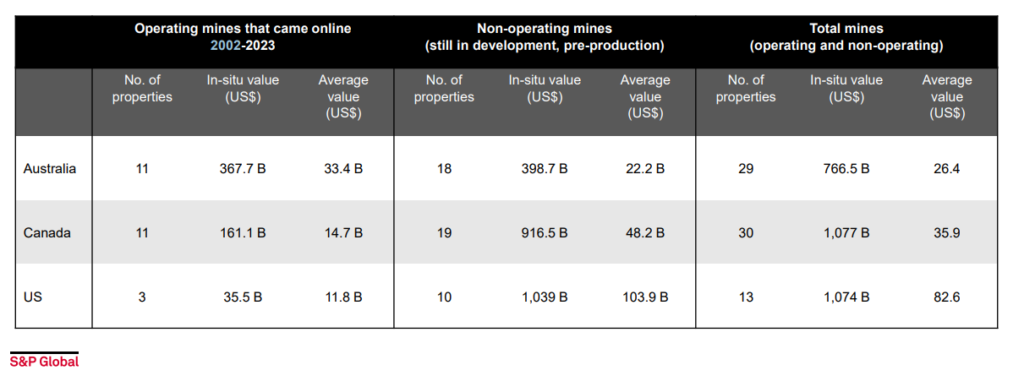

Only three mines have come into production in the United States since 2002, while 10 additional non-operating projects have remained in development for decades—one having been in development since 1978.

“Preproduction value of the 10 U.S. mines still in development, though not yet operating, represents a value of more than $100 billion worth of copper, gold, lithium, and zinc,” said Mohsen Bonakdarpour, executive director, S&P Global Market Intelligence.

Ghana, the Democratic Republic of Congo, and Laos had some of the shortest development times in the world, at roughly 10 to 15 years, while Australia had an average of 20 years.

The report found that a high rate of litigation against U.S. mining projects has dampened exploration budgets in the country.

Among U.S. projects facing Indigenous and environmental opposition are Rio Tinto (NYSE: RIO; LSE: RIO; ASX: RIO) and BHP’s (NYSE: BHP; LSE: BHP; ASX: BHP) Resolution Copper project in Arizona, and Northern Dynasty Minerals’ (TSX: NDM) Pebble copper and gold project in Alaska, neither of which are permitted.

The report also found that gold mines developed the fastest globally, at an average of 15.2 years, while nickel mines developed the slowest at 17.5 years.

Where is the link to the report!

The link has been added in the first paragraph.

If you include mines not yet in operation, you are assuredly including mines that have serious viability issues and will either never make it into operation, or may take many more years to find financing for construction. These numbers may as well be completely fictitious.