For centuries, Latin America has been renowned for its vast mineral potential. Here are eight companies making the most of the opportunity as they explore in Argentina, Ecuador, Mexico and Peru.

Aldebaran Resources

Aldebaran Resources (TSXV: ALDE; US-OTC: ADBRF) is focused on its flagship Altar copper-gold project in Argentina’s San Juan province.

The company has earned a 60% stake in Altar and has informed Sibanye-Stillwater (NYSE: SBSW) that it intends to earn an additional 20% by spending US$25 million over three years.

Altar, 10 km from the Chile-Argentina border and 180 km from the city of San Juan, hosts a cluster of porphyry copper-gold systems with mineralization currently defined in four zones — Altar Central, Altar East, QDM and Radio Porphyry.

Viewing drill core at Aurania Resources’ Lost Cities Cutucu project in Ecuador. Credit: Aurania Resources

Nearby copper operations include Antofagasta’s (LSE: ANTO) Pelambres mine, Glencore’s (LSE: GLEN) El Pachon and McEwen Mining’s (TSX: MUX; NYSE: MUX) Los Azules.

In January, Aldebaran announced a collaboration with Nuton LLC, a Rio Tinto (NYSE: RIO; LSE: RIO; ASX: RIO) venture, to evaluate the use of Nuton’s primary sulphide leaching technologies at Altar. Test work is to begin in the first half of this year.

The company is drilling with four rigs and plans to update Altar’s 2021 resource estimate later this year. For now, the Altar Central and Altar East zones host 1.2 billion measured and indicated tonnes grading 0.43% copper, 0.09 gram gold per tonne and 1 gram silver for 11.4 billion lb. of contained copper, 3.4 million oz. gold and 38.6 million oz. silver. Inferred resources total 189 million tonnes grading 0.42% copper, 0.06 gram gold and 0.8 gram silver for 1.8 billion lb. copper, 400,000 oz. gold and 4.8 million oz. silver.

The QDM near-surface gold deposit holds 20 million measured and indicated tonnes grading 0.78 gram gold, 3.62 grams silver and 0.06% copper, with 1.2 million inferred tonnes averaging 0.58 gram gold, 5.34 grams silver and 0.03% copper. There is no resource estimate yet for the Radio Porphyry intrusion deposit that sits below the QDM deposit.

South32 (ASX: S32) owns a 14.8% stake in Aldebaran, with Sibanye-Stillwater holding 14.3%. Aldebaran was spun out of Regulus Resources in 2018.

It has a market cap of roughly $121 million.

Argentina Lithium & Energy

Argentina Lithium & Energy’s (TSXV: LIT; US-OTC: LILIF) top battery metal projects in Argentina are Rincon West and Antofalla North, which have captured the interest of Amsterdam-based carmaker Stellantis (NYSE: STLA).

In September, Stellantis invested the equivalent of US$90 million in Argentine pesos in Argentina Lithium & Energy through its Argentine subsidiary.

The carmaker, whose brands include Alfa Romeo, Chrysler, Citroen, Fiat, Opel, Maserati, Peugeot, Jeep and Vauxhaul, now owns 19.9% of Argentina Lithium’s subsidiary, with Argentina Lithium retaining an 80.1% stake. Under the deal, if the junior becomes a lithium producer, Stellantis will secure a seven-year offtake agreement for up to 15,000 tonnes of lithium carbonate per year.

The Rincon West project shares the Rincon Salar in Salta province with Rio Tinto’s (NYSE: RIO; LSE: RIO; ASX: RIO) adjacent Rincon project and with Argosy Minerals’ (ASX: AGY) Rincon project to the east. Drill result highlights at Rincon West have included 153 metres grading from 329 to 393 mg per litre lithium in hole RW-DDH-006 and 132 metres of 334 to 382 mg per litre in hole RW-DDJ-004.

The Antofalla North project on the Antofalla Salar, is 25 km from Livent’s (NYSE: LTHM) Fenix lithium mine at Salar del Hombre Muerto and the project’s southernmost boundary is adjacent to properties controlled by lithium giant Albemarle (NYSE: ALB).

In addition to Rincon West and Antofalla, the company has two earlier stage projects — Pocitos and Incahuasi. Pocitos is about 38 km from Rincon West and Incahuasi is on the namesake Salar.

Argentina Lithium, which is part of the Grosso Group, has a market cap of about $37.6 million.

Aurania Resources

Aurania Resources (TSX: ARU) is exploring for gold, copper and silver in Ecuador. Its flagship asset, the Lost Cities-Cutucu project, is in the eastern foothills of southeastern Ecuador’s Andes mountain range.

The project has three distinct target areas: epithermal gold, porphyry copper and sediment-hosted copper-silver/silver-zinc.

Aurania’s Awacha porphyry target is about 11- by 5-km in size and was discovered by stream-sediment sampling that showed elevated copper and molybdenum in the vicinity of two strong airborne magnetic anomalies. The company has also mapped intrusive rock types there including gabbro, diorite, monzonite and syenite.

In a news release last April, Aurania noted that Awacha’s size “is significantly larger than any copper porphyry known” and therefore the company’s “working hypothesis” is that it is a cluster of porphyries.

The company is also exploring for copper at its Tatasham porphyry target near the western margin of its Lost Cities–Cutucu concession area. In March 2023, Aurania announced that it had unexpectedly discovered a large epithermal system there that it believes has similarities to the Fruta del Norte gold deposit, 100 km to the south.

Aurania reported that three drill holes intersected a hydrothermal system with breccias, strong silicification and high temperature illite-clay alteration, and said it thinks that the porphyry target “is still valid, but it may lie at a considerable depth, or it may lie laterally.”

Chairman and CEO Keith Barron owns about 43% of the company’s outstanding shares. Barron is credited with Aurelian Resources’ discovery of Fruta del Norte in 2006, which Lundin Gold (TSX: LUG) put into production in 2019.

Aurania has a market cap of $15.9 million.

Aztec Minerals

Aztec Minerals (TSXV: AZT; US-OTC: AZZTF) is advancing its Cervantes project in Mexico, 160 km east of Hermosillo in southeastern Sonora state.

The company’s first drill program at Cervantes six years ago partially outlined an oxide gold cap to a new porphyry gold-copper discovery at the project’s California zone, with drill intercepts including 160 metres grading 0.77 gram gold in hole 18CER010.

Since 2016 the company has drilled 12,130 metres in 67 drill holes and continues to see significant widths of gold mineralization. Highlights include 137 metres grading 1.49 grams gold per tonne from surface with a sub-interval of 51.7 metres of 3.42 grams gold in hole CAL22-005; 165 metres of 1 gram gold from surface including 24.4 metres of 4.25 grams gold in CAL22-004; and 152 metres of 0.87 gram gold from 41 metres downhole, including 33.5 metres of 2.05 grams gold in CAL22-012.

Last year, Aztec completed 13 reverse-circulation holes for 1,650 metres. The program expanded the potential mineralization area of the primary California zone oxide gold target to 1 km of strike by 300 metres of width. Drill hole CAL23-034 returned 30.4 metres grading 1.04 grams gold from 53 metres including 1.5 metres of 13.8 grams gold.

This year’s drill program will continue stepping out the shallow near-surface gold oxide mineralized zone at the California target, and other targets, such as California Norte, Jasper, Purisima East and West, and Estrella.

Cervantes is 60 km west of Alamos Gold’s (TSX: AGI; NYSE: AGI) Mulatos epithermal gold mine, 45 km west of Agnico Eagle’s (TSX: AEM; NYSE: AEM) La India mine and 40 km northwest of Minera Alamos’s (TSXV: MAI; US-OTC: MAIFF) Santana gold deposit.

Outside Latin America, Aztec owns a 75% stake in the Tombstone project in Arizona, 100 km southeast of Tucson.

Aztec has a market cap of $20.7 million.

Condor Resources

Peru-focused Condor Resources (TSXV: CN) has 12 precious and base metal targets at various stages of exploration. Pucamayo, its flagship, sits 185 km southeast of Lima, and is about 25 km east of Nexa Resources’ (NYSE: NEXA) Cerro Lindo lead-zinc-copper mine and 56 km southwest of Minera IRL’s (CSE: MIRL; US-OTC: MRLLF) Corihuarmi gold mine.

Condor conducted its first drill drill program there in December Highlights included a 72.5-metre intercept grading 0.45 gram gold per tonne, 30 grams silver and 0.14% zinc (0.83 gram gold-equivalent) in drill hole PUC-E-005. The interval included 2-metres of 11.43 grams gold, 687 grams silver, 0.11% lead and 0.21% zinc (18.96 grams gold-equivalent).

In January, Condor completed an option and joint-venture agreement with Teck Resources (TSX: TECK.A/B; NYSE: TECK) on its Cobreorco copper-gold project. Teck can earn 55% of the porphyry-skarn project over three years and has the option to increase ownership to 75% over an additional three years.

The project in south-central Peru, about 120 km west of China-backed MMG’s Las Bambas copper mine, has outcropping porphyry and skarn-related copper-gold occurrences. A sampling program in 2019 of 51 rock channel samples, typically over a 2-metre length, tested over 1% copper for nine samples and between 0.1% and 1% copper for 29 samples. Gold values were as high as 10.8 grams gold per tonne, with 19 of the samples testing over 1 gram gold.

Condor’s two other high-priority projects are Huinac Punta, where it is targeting disseminated bulk-tonnage silver, copper and zinc, and Andrea, a high-sulphidation gold-silver target, with similarities to Pucamayo.

Among Condor’s other projects is Soledad, 260 km northwest of Lima and about 34 km south of Barrick Gold’s (TSX: ABX; NYSE: GOLD) former Pierina gold mine. Condor has optioned Soledad to Chakana Copper (TSXV: PERU; US-OTC: CHKKF).

Condor has a market cap of about $19.8 million.

Kuya Silver

Kuya Silver (CSE: KUYA; US-OTC: KUYAF) is focused on its main Bethania project, 316 km from Lima in central Peru. Bethania contains a mine that opened in 1977 and last produced silver-lead and zinc concentrates in 2016.

In January, the company began an underground development and reconditioning program as a step toward restarting production later this year.

In November 2023, commodities group Trafigura invested US$1.2 million in the company to support the restart of production. The mine is permitted to produce up to 350 tonnes per day.

In October, Kuya signed a toll milling agreement with Compania Minera San Valentin to process material at its plant, 20 km from Bethania.

At a base case silver price of US$25.40 per oz., Bethania would have an after-tax net present value (at a 5% discount rate) of US$54.7 million and an internal rate of return of 188%, according to an updated preliminary economic assessment (PEA) in October 2023.

A resource for Bethania in 2022 outlined 404,000 indicated tonnes grading 332 grams silver per tonne for 4.3 million oz. contained silver and another 5.6 million oz. contained silver in 700,000 inferred tonnes grading 249 grams silver.

In addition to exploration in and around the historic mine, the company has found new veins at the project. Samples from the Santa Elena vein returned up to 3,675 grams silver-equivalent per tonne. The Carmen vein intersected up to 6.26 grams gold at surface. And about 3.5 km from Bethania, the Carmelitas Norte prospect sampled up to 19 grams silver equivalent.

Outside Peru, Kuya owns the Silver Kings project in northern Ontario and has a partnership with Sumou Holding, a Saudi Arabia-based investment company. In February, the partnership was awarded the Umm Hadid silver-gold-copper-lead-zinc mineral concession near the centre of the Arabian Peninsula.

The company has a market cap of $22.8 million.

Latin Metals

Prospect generator Latin Metals (TSXV: LMS; US-OTC: LMSQF) has 16 exploration projects and two royalties in Argentina and Peru.

In Argentina the company’s best-known projects include Organullo (copper-gold), Cerro Bayo (gold-silver) and Esperanza (copper-gold). In Peru, its portfolio includes Lacsha (copper), Auquis (copper-gold), Tillo (copper) and Jascha (copper).

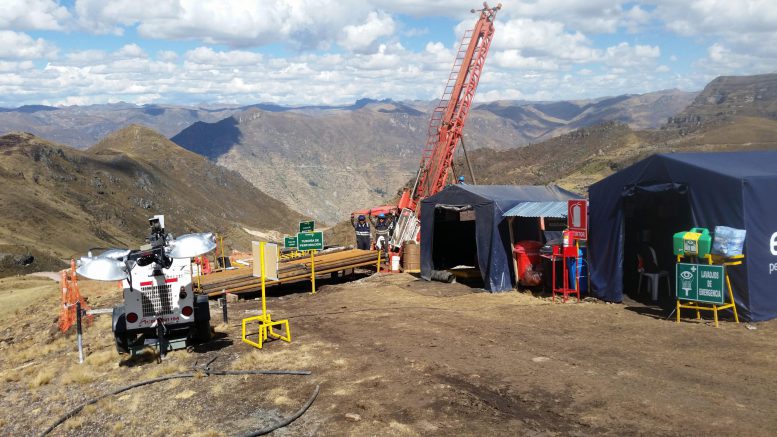

Latin Metals’ drills in Argentina. Credit: Latin Metals

AngloGold Argentina Exploraciones S.A., a subsidiary of AngloGold Ashanti (NYSE: AU), has an option to earn 80% of the Organullo project. The major has completed an airborne geophysical survey collecting magnetic and radiometric data over most of the project area, which will assist in finalizing drill targets. Organullo is about 100 km northwest of Salta.

Latin Metals has various projects for option, including Esperanza, Cerro Bayo and Lacsha.

Esperanza, in Argentina’s San Juan province, is a copper-gold porphyry project where more than 8,500 metres of drilling have been completed. The best intercept returned 387 metres grading 0.57% copper and 0.27 gram gold per tonne from surface in hole 18-ESP-025. Esperanza is about 135 km north of the provincial capital San Juan and 175 km from Filo Corp.’s (TSX: FIL; US-OTC: FLMMF) Filo del Sol deposit. Latin Metals has the option to earn 100% of the project, subject to a 2% net smelter return royalty to the underlying owner.

Cerro Bayo, a silver-gold epithermal project, is in the Deseado Massif of Argentina’s Santa Cruz province. Exploration by Barrick Gold in 2022 and 2023 defined eight drill target areas.

Lacsha, a copper-molybdenum porphyry project in Peru’s coastal copper belt, was staked by Latin Metals and the company has completed surface exploration, identified drill targets, signed a three-year agreement with local stakeholders and secured a drill permit for testing its targets. Rock chip samples returned results that included 52 metres grading 0.38% copper.

About 49% of the company’s shares are held by the board and management.

Latin Metals has a market cap of about $5.7 million.

Tinka Resources

Tinka Resources (TSXV: TK; US-OTC: TKRFF) has two adjacent projects in Peru — the Ayawilca zinc-tin-silver project and the Silvia copper-gold project. The projects are about 200 km north of Lima in the Pasco region of central Peru.

In February, the company completed an updated PEA on Ayawilca. The study outlined a 21-year mine life for a 2-million-tonne-per-year zinc-silver-lead operation along with 15 years of tin production at 300,000 tonnes per year.

Pre-production capex for an underground mine was pegged at US$382 million with an after-tax payback period of 2.9 years. Ayawilca’s post-tax net present value (at 8% discount rate) was assessed at US$433.4 million and the internal rate of return at 25.9%. All-in sustaining costs per pound of payable zinc came to US55¢. The study used base case prices of US$1.30 per lb. zinc; US$1 per lb. lead, US$22 per oz. silver, and US$11 per lb. tin.

Ayawilca’s Zinc zone deposit hosts 28.3 million indicated tonnes grading 5.82% zinc, 16.4 grams silver per tonne, 0.2% lead and 91 grams indium; with 31.2 million inferred tonnes of 4.21% zinc, 14.5 grams silver, 0.2% lead and 45 grams indium. The tin zone holds 1.4 million indicated tonnes averaging 0.72% tin and 12.7 million inferred tonnes grading 0.76% tin. The Silver Zone has 1 million inferred tonnes grading 111.4 grams silver, 1.54% zinc, and 0.5% lead.

The Silvia project, which Tinka bought from BHP Peru in July 2021, hosts two priority copper targets with outcropping skarn and coincident copper and geophysical anomalies. The project is about 80 km south and along strike of Antamina, one of Peru’s largest copper mines, jointly owned by Teck Resources, BHP (NYSE: BHP; LSE: BHP), Glencore, and Mitsubishi.

Tinka Resources has a market cap of about $47 million.

But what about Aldebaran’s sister company Regulus Resources with a large fully explored Cu/Au property in a Brownfield setting? One of the best prospects out there and the closest to being able to get into production reasonably quickly.