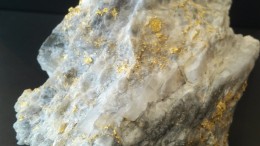

TNM Data Miner: Top 5 gold intercepts worldwide in November

Tapping into the IntelligenceMine database of our sister company Infomine, The Northern Miner has compiled the five projects recording the top gold intersections (grade multiplied by width) globally in or…