First Majestic Silver (TSX: AG; NYSE: AG) is buying fellow Canadian explorer and developer Gatos Silver (TSX: GATO; NYSE: GATO) in an all-share transaction valued at US$970 million.

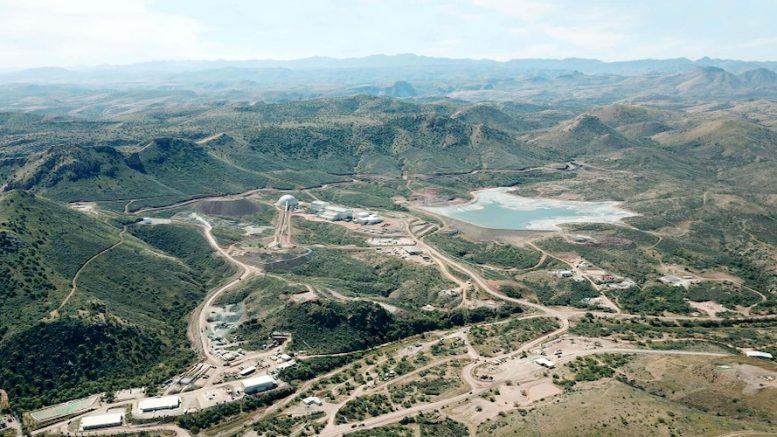

The move hands First Majestic a group of high-grade, large silver deposits in the Los Gatos silver district of Mexico’s Chihuahua state. The combination of the two companies’ assets would consolidate three silver-producing mining districts in Mexico under one banner: Gatos’s Cerro Los Gatos mine will join First Majestic’s San Dimas mine, in Durango, and Santa Elena operation, in Sonora, they said Thursday.

Gatos shareholders would receive 2.55 common shares of First Majestic, or $13.49, for each share they own. This implies a premium over the closing price on Sept. 4, and the 20-day volume weighted average prices up until that date.

After the closing, expected early next year, the merged company would produce 30 to 32 million oz. of silver-equivalent a year, including 15 million to 16 million oz. of silver, while delivering cost savings as well as supply chain and procurement synergies.

Gatos shareholders will then hold about 38% of First Majestic’s shares on a fully diluted basis.

The Los Gatos district comprises 14 mineralized zones identified to date, including three silver-lead-zinc deposits: the Cerro Los Gatos mine, the Esther deposit, and the Amapola deposit.

Vancouver-based First Majestic also owns the La Encantada silver mine in northern Mexico’s Coahuila state and has a portfolio of development and exploration projects, including the Jerritt Canyon gold project in Nevada.

Solid silver and gold prices paired with a positive macroeconomic outlook in Latin America has led to an increase in foreign investment in the region.

Analysts expect more mergers and acquisitions to come in Latin America this year and next. According to Alessio Mazzanti, managing director of Latam Investment Banking, the surge of deals will be driven by a combination of macroeconomic and political factors that are improving investors’ perceptions towards the region, particularly in major economies like Brazil, Chile, and Mexico.

Shares in Gatos jumped almost 8% in pre-market trading in New York to hit $12.54 each. The stock has had an extraordinary performance this year, recording an 89.25% increase to date.

Be the first to comment on "First Majestic to expand in Mexico with US$970M Gatos Silver buy"