When the levee breaks, a common safe haven for the investment community is gold. But according to the World Silver Survey 2010, prepared by GFMS for the Silver Institute, despite the financial bedlam of the recession and Europe’s sovereign debt crisis, silver prices reached peaks not seen since 1980.

Citing strong investor demand and a recovery in industrial demand over the past year, silver posted an average price of US$14.67 per oz. in 2009, the second highest average for the white metal since the 1980s.

Of course, the global recession was at the root of some trouble for silver. In early 2009, fabrication demand fell sharply but rebounded in the second half of the year and continues its streak in early 2010.

According to the report, flat supply is expected for 2010 with solid gains in fabrication demand.

Silver price and investment

With the price at US$14.67 per oz. in 2009 (a 53% intra-year rise), the report credits a rise in demand for silver exchange traded funds (ETFs) and physical retail investment.

In 2008, 265.3 million oz. of silver flowed into the coffers through ETFs. Total ETF holdings rose by 132.5 million oz. in 2009, ending at 397.8 million oz. as new funds enter the marketplace from Australia and the United States.

Another clear indicator of silver’s strength was a rise in demand for the U.S. Silver Eagle bullion coin program, which reached a milestone in 2009, selling over 28 million coins.

Overall coin and medal fabrication climbed 21% to a new record of 78.7 million oz. on the back of a jump in retail demand from the United States with pre-debt crisis, Western Europe posting strong demand for 2009 as well. Silver bars also experienced a surge in demand in the United States.

The report puts the coin demand in perspective: between 1986 and 2008, U.S. Eagle minting average a mere 7.7 oz. per year.

Silver demand

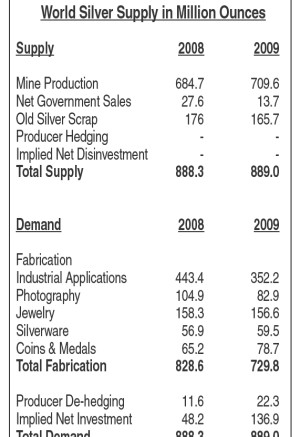

Demand did tarnish silver’s sterling year, falling 11.9% to 729.8 million oz. from the previous year’s 828.6 million oz.

The bulk of the decrease in fabrication demand was caused by the global financial crisis, which sharply dropped industrial offtake to levels not seen since 2003.

The survey goes on to analyze the drop in industrial demand, crediting significant inventory cuts in the industrial supply pipeline and a protracted decline in end-user orders from a far weaker automotive industry. Losses were felt most in East Asia, North America and Europe.

The light at the end of the tunnel was visible beyond the first quarter, as markets showed signs of gradual improvements, according to the author of the report.

World silver supply and demand

Implied net silver investment shone for the white metal, seeing an uncanny 184% rise to 136.9 million oz., the highest in 20 years.

World jewelry demand dipped 1.1% in 2009 to 156.6 million oz. from 2008’s 158.3 million oz. India and China posted increases in silver-laden jewelry just enough to offset losses in other markets.

Silverware demand flipped the table byrising 4.6% to 59.5 million oz., with a little help from increases in Indian fabrication.

An odd byproduct of the recession was a fall in photographic demand, which holds its own niche in the silver market. Plainly speaking, people took fewer photos and those who did used digital cameras and less film. Demand in this market fell to 82.9 million oz.

Producer de-hedging of silver contracts rose substantially in 2009 to 22.3 million oz. as several large silver hedge books were wound up.

The mining side

Silver mine production increased by 4% to 709.6 million oz. in 2009. Production was linked to both primary silver mines and silver as a byproduct.

At the centre of the increase was Latin America, where silver output increased by 8% and, with help from producing mines in Argentina and Bolivia. Peru wore the crown as top producer followed by Mexico, China, Australia and Bolivia. With the exception of Australia, where output from the lead/zinc sector declined, all of these countries saw an increase in output.

Global primary silver supply saw a 7% increase to account for 30% of total mine production in 2009.

Primary silver mine cash costs remained stable year-on-year, rising less than 1% to US$5.23 per oz.

Net silver supply from above-ground stocks dropped 86% to 20.2 million oz. in 2009, driven by a surge in net investment, higher de-hedging, lower government sales and a drop in scrap supply.

Scrap supply fell 6% from 2008’s figure to a 13-year low of 165.7 million oz. This was the third consecutive year of losses in the scrap category.

Government stocks of silver are estimated to have fallen by 13.7 million oz. last year, to reach their lowest levels in more than a decade. Russia again accounted for the bulk of government sales, with China and India for the most part absent from the market in 2009. In respect to China, precious metals consultancy GFMS says that after years of heavy sales, its silver stocks have been reduced significantly.

–The full report can be purchased at www.silverinstitute.orgor www.gfms.co.uk

Be the first to comment on "Silver market strong in 2009: Silver Institute"