Over the Aug. 22-26 trading period, the S&P/ TSX Composite Index fell 238.09 points or 1.18% lower, to 19,873.29. The S&P/TSX Global Mining Index gained 2.37 points or 2.54% to 95.54, and the S&P/TSX Global Base Metals Index gained 8.5 points or 5.28% to 169.6. The S&P/TSX Global Gold Index fell by 2.89 points or 1.22% to 233.36, and spot gold ended the week at US50¢ per oz. higher, or 0.29%, at US$1,751.25 per ounce.

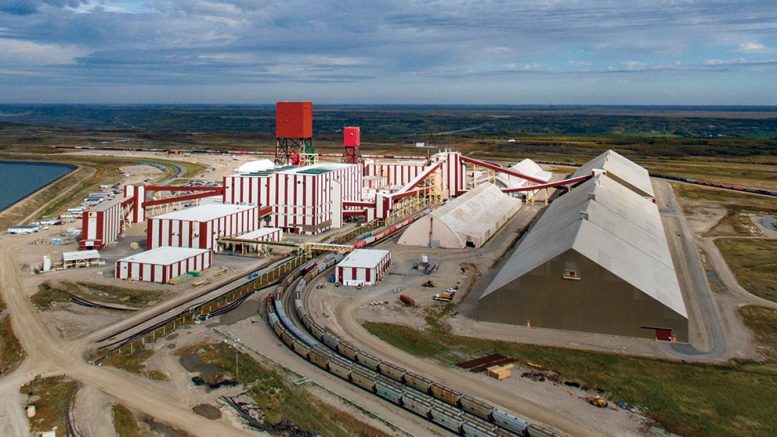

The top gainer by value for a third consecutive week was Nutrien, gaining $13.47 to close at $130.88 – up almost 12% week-on-week. The company has recently reported record interim profits, underpinned by a supply squeeze brought on by Russia’s war in Ukraine. Prices for potash, an essential crop input, have recovered to multi-year highs pushing up Nutrien’s net profit for the June quarter up by 224% year-on-year to US$3.6 billion.

The second-best issuer in terms of value growth was Turquoise Hill Resources, which added $5.76 per share to close the week at $36.95. The single-asset company which holds 66% of one of the world’s largest known copper and gold deposits, 550 km south of Mongolia’s capital Ulaanbaatar. It said its board was reviewing a sweetened bid by Rio Tinto (ASX: RIO) after rejecting an earlier bid in March to buy the 49% stake it didn’t already own in the company for US$2.7 billion. Turquoise Hill rebuffed the bid, saying it did not reflect its full and fair value. To boost its chances of gaining direct ownership of the massive Oyu Tolgoi copper-gold mine, Rio now offers US$3.1 billion, translating to Turquoise Hill minority shareholders receiving $40 (US$31) per share. Turquoise Hill’s shares rose as much as 24% after the new offer on Aug. 24, while Rio’s share price fell 2% in London. Rio Tinto and the Mongolian government, which owns the remaining 34% of Oyu Tolgoi, earlier this year ended a long-running dispute over the US$7 billion expansion of the mine. Rio said its improved offer is conditional on Turquoise Hill not raising equity of more than US$1 billion that it had said it needs to finance the project. In May, Rio agreed to provide interim debt funding of up to US$400 million.

Staying with value gainers, shares in Cameco added $5.47 to close the week at $34.74. The uranium sector is perking up following news from Japan of a central government and public policy and opinion shift towards restarting idled reactors. On Aug. 24, Prime Minister Fumio Kishida announced that Japan would restart more suspended nuclear power plants and look at developing next-generation reactors. This represents a significant policy shift amid soaring energy costs, a global fuel shortage, and extreme weather. Analysts expect the announcement by Japan, and other major global economies, to translate into increased uranium demand growth. As Canada’s largest uranium producer, Cameco, in its recent second-quarter results release, said that power utilities were again returning to long-term contracting to lock in future uranium supplies as power utilities pivot toward procurement strategies that more carefully weigh origin risk.

Be the first to comment on "TSX closes in the red during Aug. 22-26"