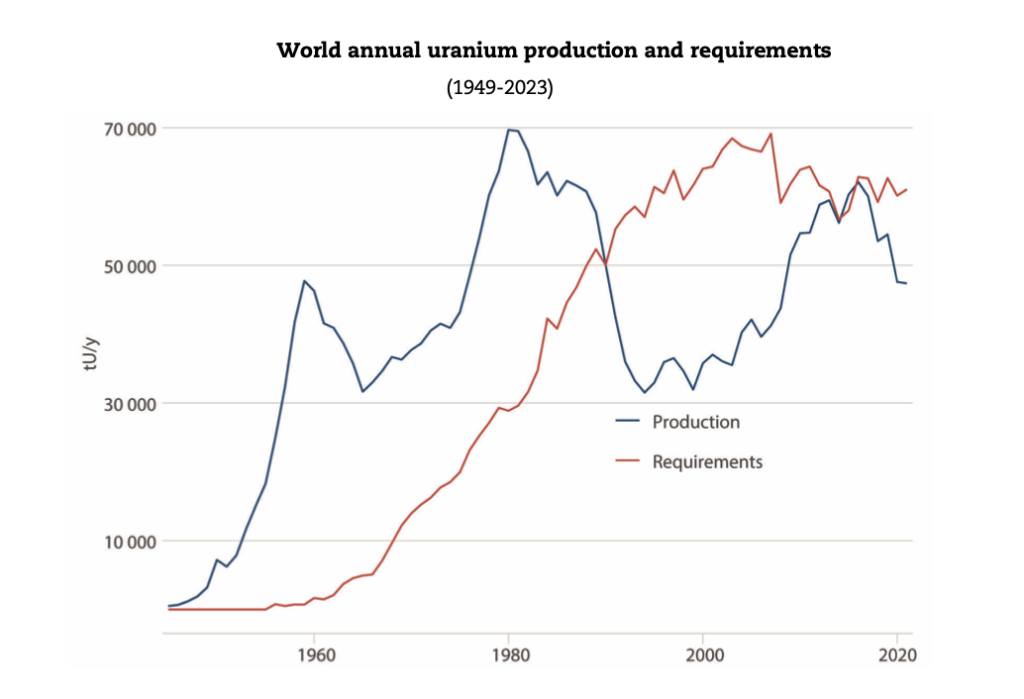

Global uranium reserves could be exhausted by the 2080s if demand for nuclear energy continues expanding at its current pace, the Paris-based Nuclear Energy Agency and the UN’s International Atomic Energy Agency warned in a report released Tuesday.

Demand for uranium is surging as countries and companies turn to nuclear power to reduce fossil fuel use and support the rapid growth of artificial intelligence (AI)-related power-hungry data centres, according to the agencies’ biennial Red Book.

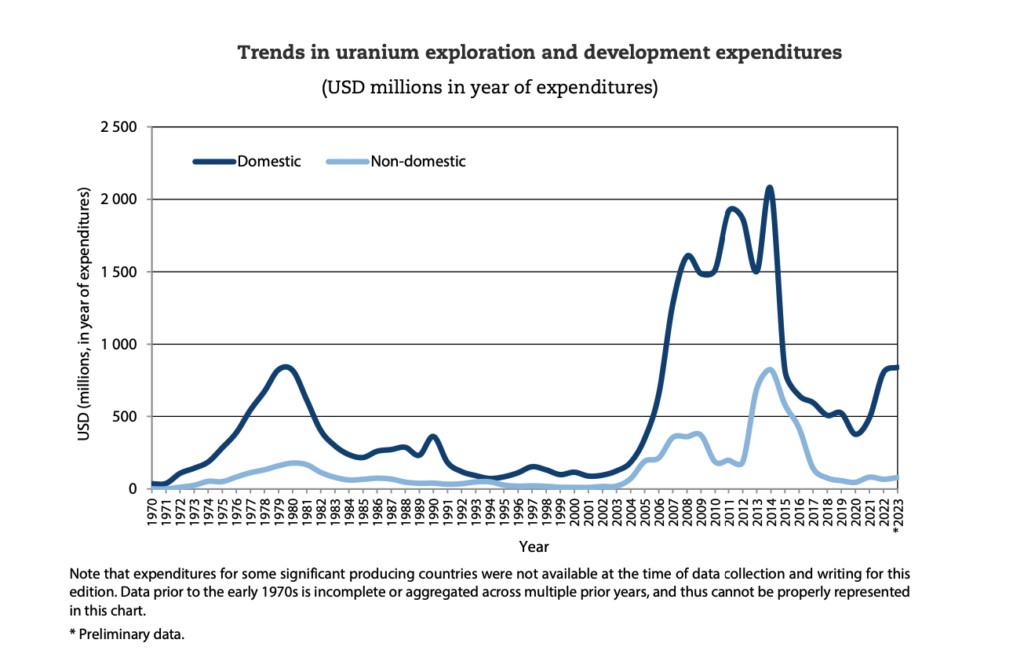

Without major new investment in uranium exploration and mining, supply may not keep up, the NEA, an adviser to developed countries, and the IAEA, the global promoter of peaceful nuclear uses, said in the report.

While the agencies conclude that enough uranium exists to support a “high-growth” scenario through 2050 and beyond, it stresses that unlocking those resources will require significant spending on exploration, mining operations and new processing techniques.

Under that high-growth outlook, global nuclear capacity would rise 130% by 2050 compared to 2022 levels. However, that estimate is based on policies and data available at the start of 2023 — before a wave of renewed interest in nuclear energy by both governments and the private sector.

East Asia is expected to see the largest growth, with capacity potentially increasing by up to 220% over the 111 gigawatts of nuclear power it had at the end of 2022. Meanwhile, countries including the U.S., U.K., South Korea and 20 others have pledged to triple global nuclear capacity by mid-century to help meet net-zero targets.

US output rises

Private investment up

Private sector investment is also climbing. Tech giants including Google, Amazon and Meta are betting on nuclear, investing heavily in the sector to power the next generation of energy-intensive data centres fuelling AI development.

The International Energy Agency, which collects data for the Organization for Economic Co-operation and Development, also the parent of the NEA, said in January that nuclear power has entered “a new era.” Interest is at its highest level since the 1970s oil shocks, it said.

The IEA noted that annual nuclear investment rose nearly 50% between 2020 and 2023.

- with files from Blair McBride

Be the first to comment on "Uranium supply could dry up by 2080s: OECD, UN"