One of the world’s leading gold-focussed royalty companies today, the roots of Franco-Nevada’s successful journey lie in the purchase of its first royalty on the Goldstrike mine in 1986.

But ask Pierre Lassonde, the company’s co-founder who planned the purchase, and he will tell you that he “didn’t really know what he was doing.” In fact, soon after the purchase, his partner, Seymour Schulich, went “ballistic” on him after Schulich heard that Lassonde had agreed to spend $2 million, or all of the company’s money in the treasury for the royalty.

Shortly after Franco’s investment though, Barrick Gold (TSX: ABX; NYSE: GOLD) purchased the mine and revealed a 50 million oz. orebody which kickstarted Franco-Nevada’s royalty business in the best possible way. While Lassonde was confident of getting his money back, he didn’t expect to earn it back by such a big margin.

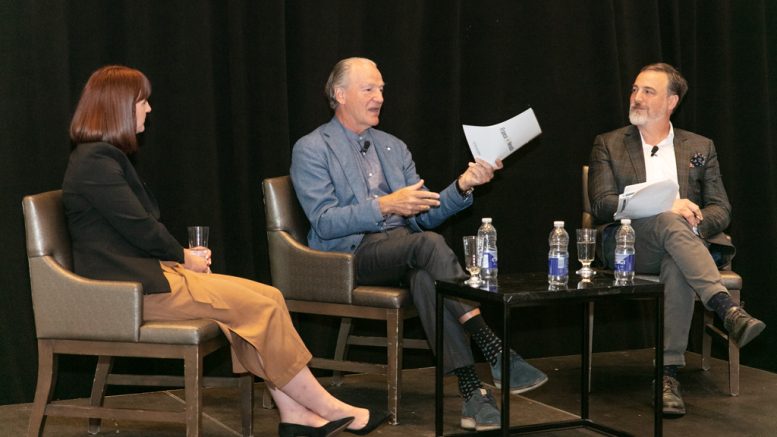

“That’s optionality for you,” said Lassonde at the Mining Legends Speaker Series, organized by The Northern Miner, the Canadian Mining Hall of Fame and Young Mining Professionals on June 8 in Toronto.

The recurring Mining Legends series pairs CMHF inductees with accomplished young talent — in this case Orix Geoscience president and CEO Ashley Kirwan, who will be the subject of a separate article — to bridge the knowledge gap in the mining industry and discuss the future of mining. (See coverage of the inaugural event featuring Ross Beaty and Maggie Layman.)

“What I mean by that is that with one drill hole, we can create a billion dollars… it’s one in maybe a million drill holes, but it’s happened to me three times. And that’s unique to our business… if you can put your hands on a property with tremendous optionality, I can make you very wealthy,” he told Anthony Vaccaro, president of The Northern Miner Group, who moderated the program.

Over the 20 years since Franco was founded in 1982, the company provided its shareholders with a 36% annualized rate of return before being acquired by Newmont (NYSE: NEM, TSX: NGT) in 2002.

In 2007, Newmont decided to divest its royalty assets and Lassonde and his team launched an initial public offering to bring back the company for US$1.2 billion. Today, the company, of which Lassonde remains chair emeritus, has a market cap of about $35 billion. Lassonde is also chairman and CEO of Firelight Investments.

Entrepreneurial spirit

Lassonde, who was inducted into the Canadian Mining Hall of Fame in 2013, credits the immense freedom that he enjoyed as a child behind his desire to become an entrepreneur.

As a 14-year-old in the 1960s, Lassonde recounted how he had gone hitchhiking with his friends for a month and was barely in touch with his family during the period.

“When I came back, I remember walking up the stairs… and all my mother said was, what would you like for dinner? I’d been gone for a whole month… I wouldn’t say my parents couldn’t care less but they gave us the freedom to really be whatever we wanted to be,” he said.

But it wasn’t always his plan to enter the mining industry. Growing up, Lassonde dreamed of owning a construction company and so he ended up studying engineering and working for a construction company.

As it so happened, his first project at his job was at a mine site where he met a geologist speculating on junior stocks and ended up investing.

“As luck would have it, the very first one I bought, I made ten times my money in a space of about three months, and I thought I was God’s gift to finance,” he laughed. “Of course, the next one I bought, I lost everything. But I was hooked.”

And so, in 1982, together with Seymour Schulich, who came from the oil and gas industry, the duo started Franco-Nevada with an aim to be one of the first royalty businesses in the mining sector.

While the team of two did excel, Schulich and Lassonde were extremely different people. “He’s sort of like a cowboy, I am like French; I would come in with an idea and say, ‘I have seen something and it’s white.’ He would say, ‘it’s black.’” But “the genius came” when the duo refined their ideas to point when it was beneficial to both and the company, Lassonde said.

Green transition

Talking about the future of the sector, Lassonde believes it will be a while before the world can truly transition away from oil and gas. “That little cubic centimeter of oil is the most powerful energy intensive unit cubic we have today,” he said.”And until we come up with something better than that, we are not going to move away… it’s that simple.” he said.

He is, however, hopeful that the world will depend upon electricity for 75% of its energy use up from 25% today, by 2070. And that’s why he believes that finding copper-gold deposits is going to be the next big thing.

“When you look at the ‘greenification’ of the world, it’s all about electricity… and that’s where we’re going to need a lot of copper. And it doesn’t exist, we haven’t found it, the mines are not in production, he said. ”In terms of the next 20 to 40 years, copper and gold are going to be the place to be.”

While the increase in demand for electric vehicles (EV) has pushed prices of battery metals upward, Lassonde doesn’t expect the “billions of cars on the road right now” to switch immediately to EVs and so he has doubts about investing in lithium metal royalties.

“The fundamental question that we have is, how far is the lithium battery is going to get us? Because as it is, right now, it’s not good enough. If you own an electric car and you try to go to your cottage round trip, you can’t do it. You’re going to suffer from range anxiety,” he said. “But we like copper, because no matter what, that’s part of the green revolution.”

For information on The Northern Miner’s next Mining legends Speaker Series event, visit: https://events.northernminer.com/speaker-series/.

Be the first to comment on "Pierre Lassonde touts copper over lithium as key to green transition: Exclusive interview at the Mining Legends Speaker Series "