Mining and commodities trader Glencore (LSE: GLEN) has reported an 8.8% in its carbon emissions for 2023 as a consequence of expanding coal production and restarting an oil refinery in South Africa that was closed by an explosion.

The Swiss company totalled 432.8 million tonnes of carbon dioxide equivalent last year, compared with in 2022, reversing the downward trend of recent years.

In its 2024-2026 Climate Action Transition Plan (CATP), Glencore noted it was still “on track” to meet its 15% reduction of carbon dioxide equivalent emissions for its industrial assets from 2019 levels by the end of 2026, and of 50% by the end of 2035.

The rest of Glencore’s revised climate plan is much like a previous plan it released — but this time includes the interim 2030 target.

“[The new plan] reflects a wide range of inputs, including analysis of the evolving market landscape, new regulatory requirements, mining and energy peer approaches, the IEA’s latest modelling, stakeholder inputs, and emerging insights from the most recent United Nations Framework Convention on Climate Change (UNFCCC) dialogue,” chief executive officer Gary Nagle said in a statement.

“We have also undertaken extensive engagement with our shareholders and appreciate their time and support as we have developed this CATP,” Nagle noted.

Glencore, like most of the world’s biggest listed companies, published its first climate action plans in 2020 in a bid to help with reaching the 2015 Paris Agreement goal of capping temperatures within 1.5 degrees Celsius.

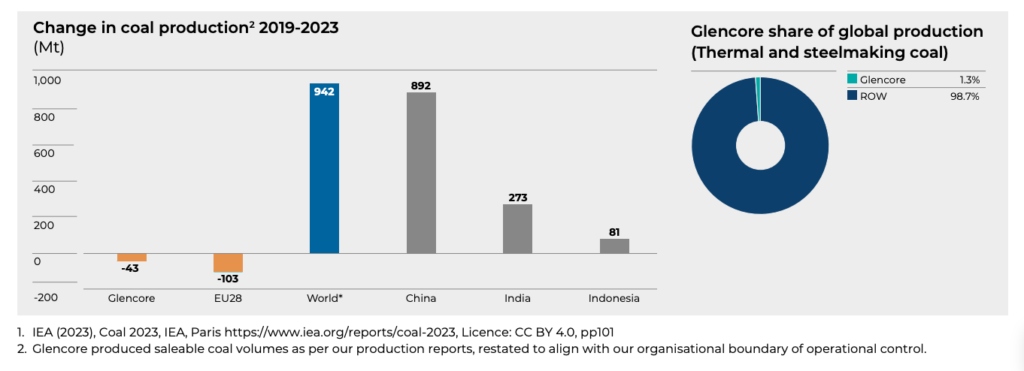

The Baar, Switzerland-based firm, one of the top global thermal coal exporters, has faced backlash for being one of the few top miners still involved in the extraction of the fossil fuel used to generate electricity.

After facing pressure from major investors and shareholders, Glencore committed to run down its coal mines by the mid-2040s, closing at least 12 by 2035.

“We recognize the different roles of thermal coal and steelmaking coal – and the different transition pathways for both,” Nagle said presenting the new strategy.

The executive noted the company “remains committed” to the responsible phase-down of its coal portfolio and it’s not progressing any greenfield thermal coal investments.

The company continues to produce and recycle commodities considered key for today’s cleaner transition technologies. Nagle explained that the speed and direction of Glencore’s decarbonization efforts are shaped by geopolitics, policy decisions, and technological advancements.

Tackling Scope 3 emissions

Glencore plans to cut “Scope 3” emissions — those produced when customers burn or process a company’s raw materials — by 30% by 2035 and achieving net zero Scope 3 emissions by 2050.

The company did not include its marketing activities in these goals. It justified the decision by saying that, by trading in the third party volumes, its activities do not generate additional Scope 3 emissions, “which in the ordinary course are associated with the transformation or use of the product by third parties.”

Glencore recently acquired a 77% interest in Teck Resources’ (TSX: TECK.A/TECK.B; NYSE: TECK) steelmaking coal business, Elk Valley Resources. The transaction remains subject to regulatory approvals and is expected to close by the third quarter.

— This story has been updated.

Be the first to comment on "Glencore’s carbon emission jumped 8.8% in 2023, reveals new climate plan"