Golden Arrow Resources (TSXV: GRG; US-OTC: GARWF) has jumped from an explorer to a silver producer in Argentina in a fairytale-esque way.

It will receive a 25% stake in Silver Standard Resources’ (TSX: SSO; NASDAQ: SSRI) producing Pirquitas mine, take home a US$15-million cheque and fast track production of its flagship Chinchillas project in a joint-venture deal, expected to close shortly.

“It’s a Cinderella story,” Joseph Grosso, Golden Arrow’s chairman, president and CEO, says in an interview. “And we are just entering the ballroom.”

The unique Golden Arrow-Silver Standard agreement — signed in late 2015 and confirmed this March — will spin out two assets into a separate private company: the Chinchillas silver-lead-zinc project and the Pirquitas silver-zinc mine in Jujuy province. The 75-25 joint venture will have majority owner Silver Standard as the operator.

Grosso describes the scenario as a “win-win” for both parties. The mill at Pirquitas was running out of ore, while the Chinchillas project needed funds to move into development.

Since 2009, Silver Standard had been processing ore at Pirquitas through its 4,000-tonne per-day mill and processing facility. By 2015, it had announced that it was closing the mill and infrastructure once the ore at Pirquitas was depleted in the coming year and a half.

Seizing the opportunity, Grosso quickly arranged a meeting with Silver Standard’s then president John Smith. The two began negotiating a deal that would see Chinchillas extend Pirquitas’ mine life and generate cash flow for Golden Arrow, even before it was developed.

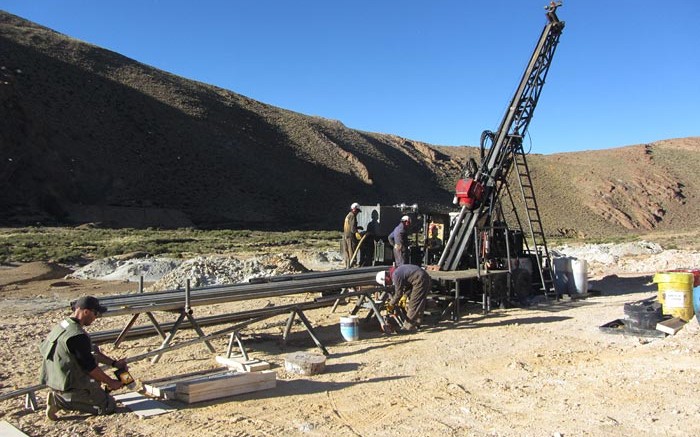

The San Miguel open pit at Silver Standard Resources’ Pirquitas mine in northern Argentina. Credit: Silver Standard.

“It’s so great that it’s almost unbelievable to be true,” Grosso says of the deal.

While Silver Standard expected Pirquitas would run out of ore in 2017, it now anticipates the joint venture will continue processing the remaining stockpiles over the next 12 months.

Over this time, the joint venture will develop the Chinchillas project, where current measured and indicated resources, inclusive of reserves, total 140 million equivalent oz. silver (29.3 million tonnes of 149 equivalent grams silver per tonne).

According to Golden Arrow’s time line, it expects the final exploitation permit for Chinchillas by the end of June 2017. Construction should kick off in the third quarter, followed by first production in the second half of 2018.

A March 2017 prefeasibility study pegs initial costs of building an open-pit mine at Chinchillas at US$81 million, using the existing Pirquitas infrastructure. Estimated sustaining costs are US$44 million.

The combination significantly lowers the project’s capital costs and production time line. Without Pirquitas’ infrastructure, valued at over US$350 million, Grosso estimates it would have taken seven years for Golden Arrow to raise the funds and build the same infrastructure required for Chinchillas.

The prefeasibility study envisions Chinchillas can produce 8.4 million equivalent oz. silver a year over an eight-year mine life. Estimated all-in sustaining costs are US$9.75 per oz. silver, net of by-products.

Golden Arrow Resources’ flagship Chinchillas silver-lead-zinc project in Argentina’s Jujuy province. Credit: Golden Arrow Resources.

The mine life is based on resources delineated on only 40 hectares of the 2,000-hectare project, Grosso says, adding there’s room for resource expansion and mine life extension.

On the financing side, Golden Arrow does not anticipate any difficulties in funding its 25% share of Chinchillas’ costs, as it has a large payment coming in from Silver Standard. It projects Chinchillas’ capital expenses at US$10 million in its first year.

Once the joint-venture agreement closes, Golden Arrow will pick up a US$15-million cheque from Silver Standard, representing its 25% interest in Pirquitas’ net profits since Oct. 1, 2015 — the day after the partners reported the original joint exploration and evaluation deal.

Grosso says that Chinchillas has “already earned Golden Arrow an income.” By the time the project reaches production, it will have generated two and half years of income.

“The deal is fantastic for Golden Arrow and it should be just as fantastic for Silver Standard,” he says, adding that Pirquitas can expand its mine life and preserve the value of Pirquitas’ infrastructure, as well as Silver Standard’s skilled operations team.

As part of the deal, Golden Arrow will receive 25% of the profits from the remaining stockpiles at Pirquitas, which have estimated values of US$45 million to US$60 million, as well as 25% of Chinchillas’ annual production.

Grosso notes that processing the stockpiles should wind down just as Chinchillas starts up.

Silver Standard confirmed it wanted to go ahead with the joint venture on March 31, 2017, coinciding with the positive prefeasibility study and concluding an 18-month preliminary period since signing the original deal.

The San Miguel pit at Silver Standard Resources’ Pirquitas silver-zinc mine, in

Argentina’s Jujuy province. Credit: Silver Standard Resources.

During the preliminary period, Silver Standard invested US$16 million at Chinchillas, largely to fund the prefeasibility study, as well as related drilling, engineering studies and metallurgical test work. The investment also included a $2-million option payment to Golden Arrow.

“I call Chinchillas a lottery ticket that won. But now we have several expensive [partial] lottery tickets that we have developed in the last 24 years,” Grosso says.

Golden Arrow is now looking to turn those projects into winning tickets. The most exciting exploration asset it has in its portfolio is the 100% owned Antofalla silver-gold-base metal project in Catamarca province.

This year, Golden Arrow has budgeted US$2 million of work at Antofalla, including 3,000 metres of drilling. It aims to drill the 87 sq. km project, which has “geologic similarities” to Chinchillas, in the second half of 2017.

The company has US$6 million in its treasury. It expects this to grow to US$21million by the end of May.

On May 5, Golden Arrow shares closed at 60¢, up from its 52-week low of 49.5¢ recorded last May. The stock hit a 52-week high of $1.48 last August.

Golden Arrow is part of Grosso Group, a private management company founded in 1993 to explore for minerals in South America. Blue Sky Uranium (TSXV: BSK) and Argentina Lithium & Energy (TSXV: LIT) are also in the Grosso Group.

Be the first to comment on "Golden Arrow teams up with Silver Standard in Argentina"